The following is the report of the ODR Task Force to the ADRIC Board, from July 2019. The 2020 interim report will be available in the coming months.

The Resources noted in this report are currently posted under Member Resources on the ADRIC portal. Here is the link: https://mbr.adric.ca/ADRIC/Communication-Members/ODR_Resources.aspx

ADRIC ODR TASK FORCE

Interim Report to Board of Directors

July 10, 2019

1. Introduction

In mid-2018 the ADRIC Board of Directors approved Terms of Reference for the ODR Task Force. Since that time the Task Force has met on a regular basis and is submitting this Interim

Report to the Board to advise of activities to date and to seek guidance from the Board regarding next steps.

2. Task Force Objectives / Status

The following is a report on the activity to date on each of the objectives contained on the Task Force terms of reference:

a. Research ODR in Canada: The Task Force will research ODR tools and platforms currently used and proposed in the public and private sector in Canada with a view to disseminating such information to ADRIC membership.

i. The Task Force has compiled a List of ODR Tools and Platforms, a copy of which is attached to this report as Appendix A. A copy has been provided to the Executive Director and the Task Force recommends that this be posted as a resource on the ADRIC website accessible by all members of the public.

ii. More work needs to be done to research a subset of these tools and platforms to determine if they would be suitable to brand or “white label” for use by ADRIC members.

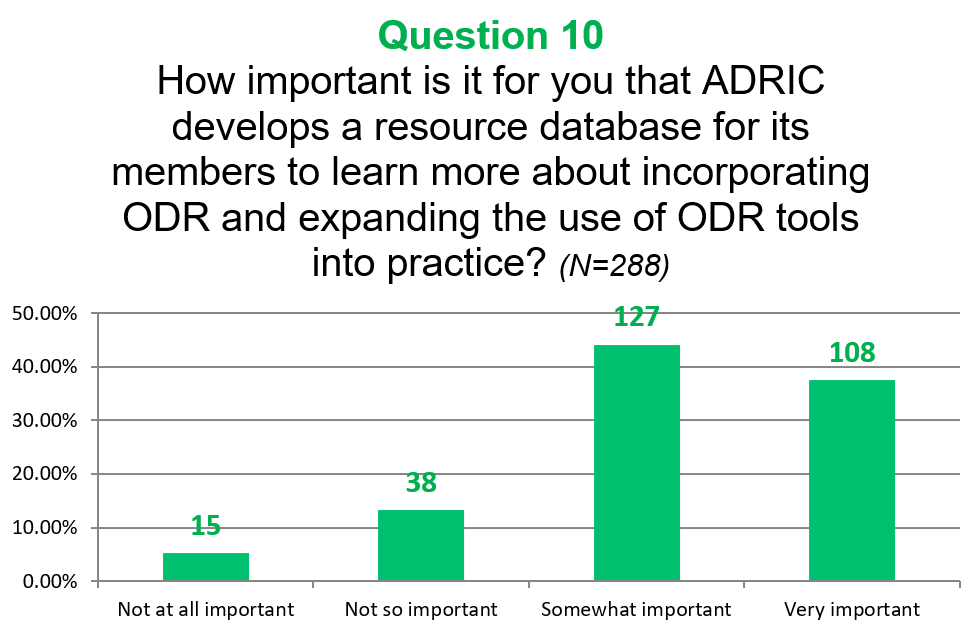

b. ODR Resource Library: The Task force will create an online library of ODR materials for the benefit of ADRIC members.

i. The Task Force has created an ODR Resource Library being a listing of ODR related articles, websites and books each web-link a copy of which is attached to this report as Appendix B. A copy has been provided to the Executive Director and the Task Force recommends that this be posted as a resource on the ADRIC website accessible by all members of the public.

ii. Decisions will have to be made as to the best method of keeping the ODR Resource Library up to date.

c. Assess ODR’s Future Potential in Canada: The Task Force will assess ODR’s future potential in Canada, in part by considering the development of ODR in other jurisdictions.

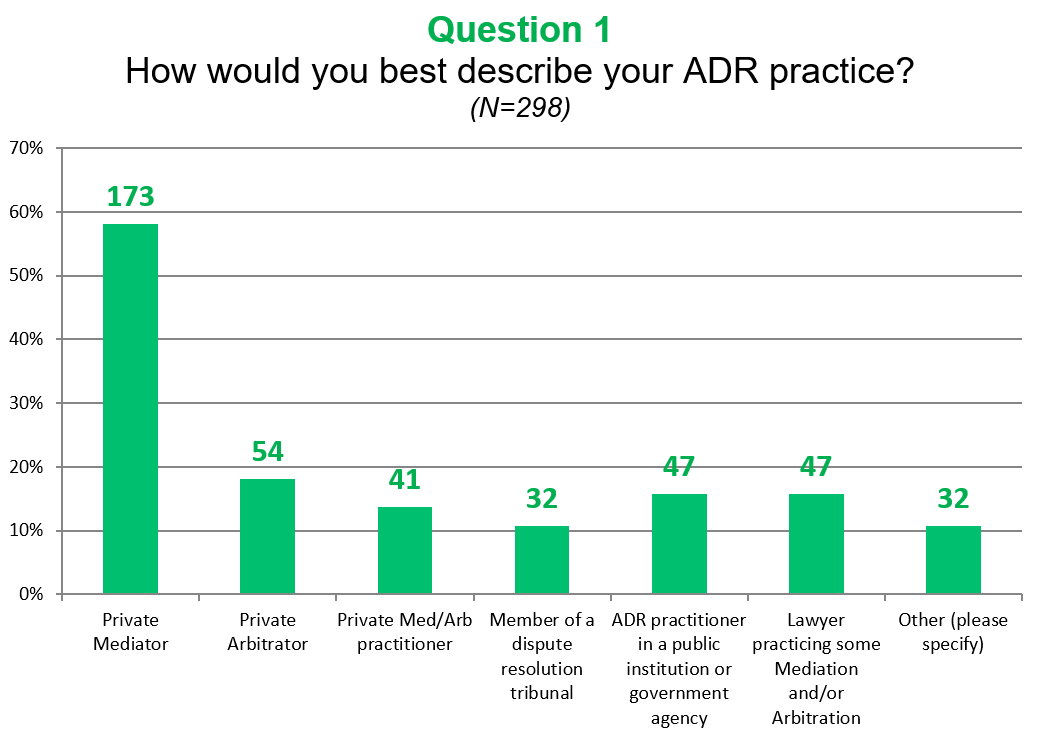

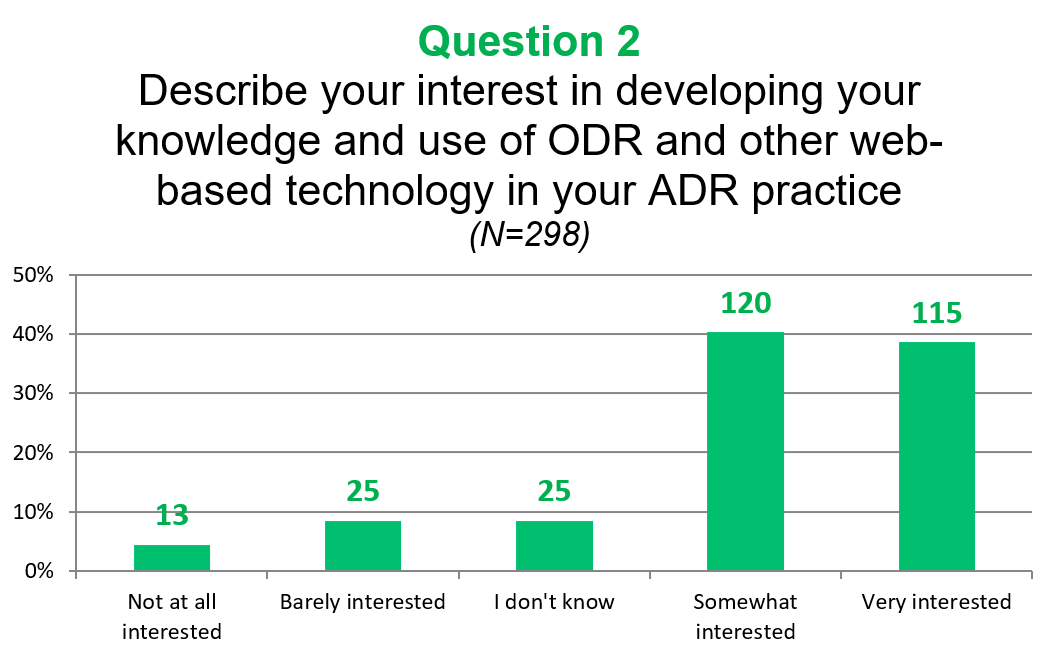

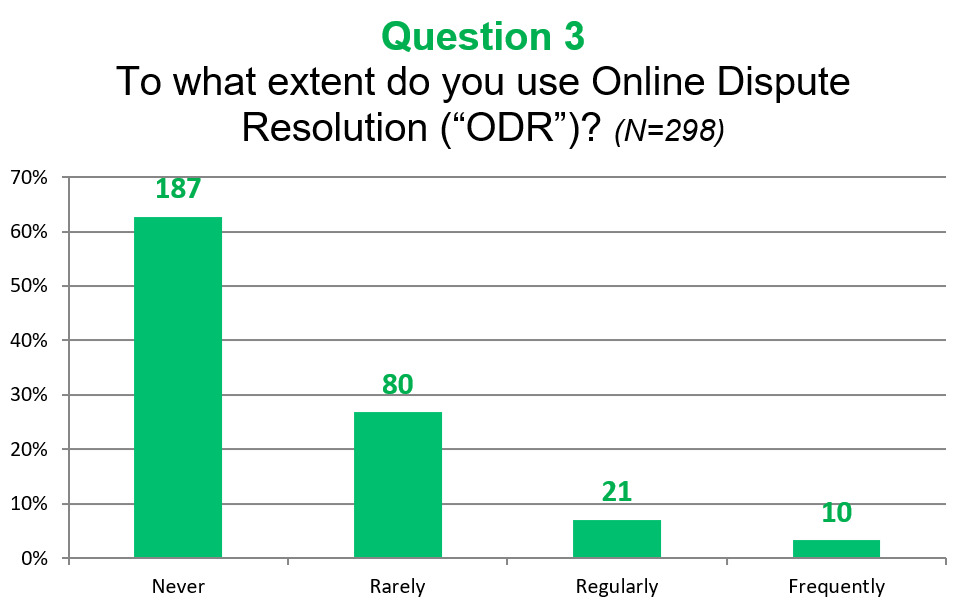

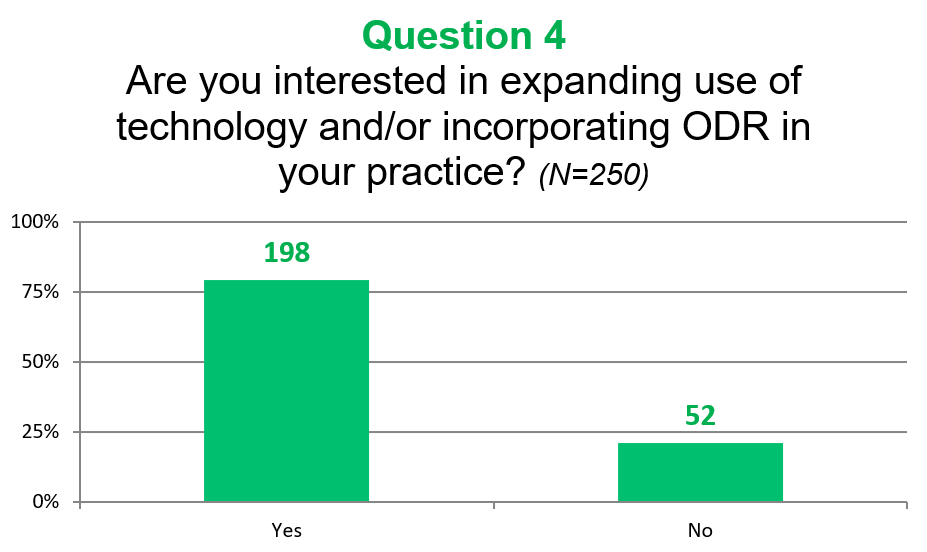

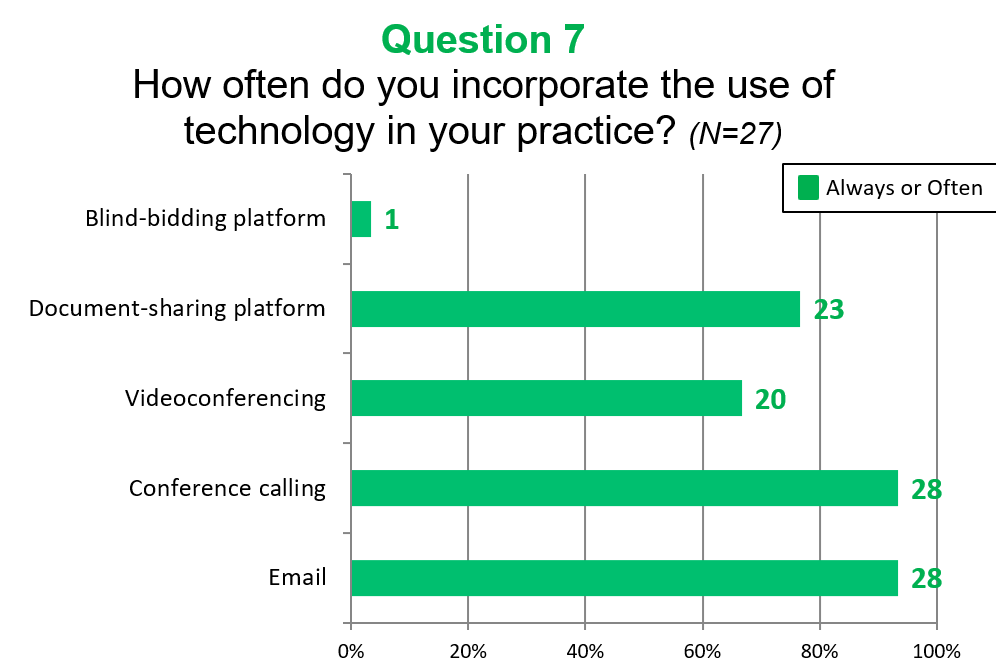

i. The Task Force conducted a survey of ADRIC Membership to determine how ADRIC members currently incorporate the use of technology in their ADR practice and to seek input as to how ADRIC can best support its membership in acquiring skills and information to be able to use ODR tools and other technology.

The following is a summary of the results. The data collected from the survey is attached to the Interim Report as Appendix C. Because of potential identifying information, some data has been redacted in the attached survey results. It is requested that the survey results be for ADRIC Board use only and not circulated.

Data Collection

The survey questionnaire was sent by email on Wednesday May 1, 2019, to approximately 2060 ADRIC members. A reminder was sent out the following week and the survey was closed

on Friday May 10, 2019. A total of 298 members answered the survey (262 in English, 36 in French) – a response rate of approximately 14.5%. This is only the second survey conducted

through email solicitation by ADRIC. Comparatively, this survey had three times the response rate of the other, which concerned the ADRIC Journal.

While the number of respondents is sufficient to conduct basic statistical analyses, the low response rate leads to question whether the respondents are representative of the ADRIC

membership. An inference may be drawn, for example, to the effect that practitioners who did not answer the survey likely have little interest for ODR altogether. It could also be that the

survey triggered curiosity among members who know little about ODR. Therefore, the ODR Task Force endeavors to use this survey with caution, not generalizing its results to the entire

ADRIC membership.

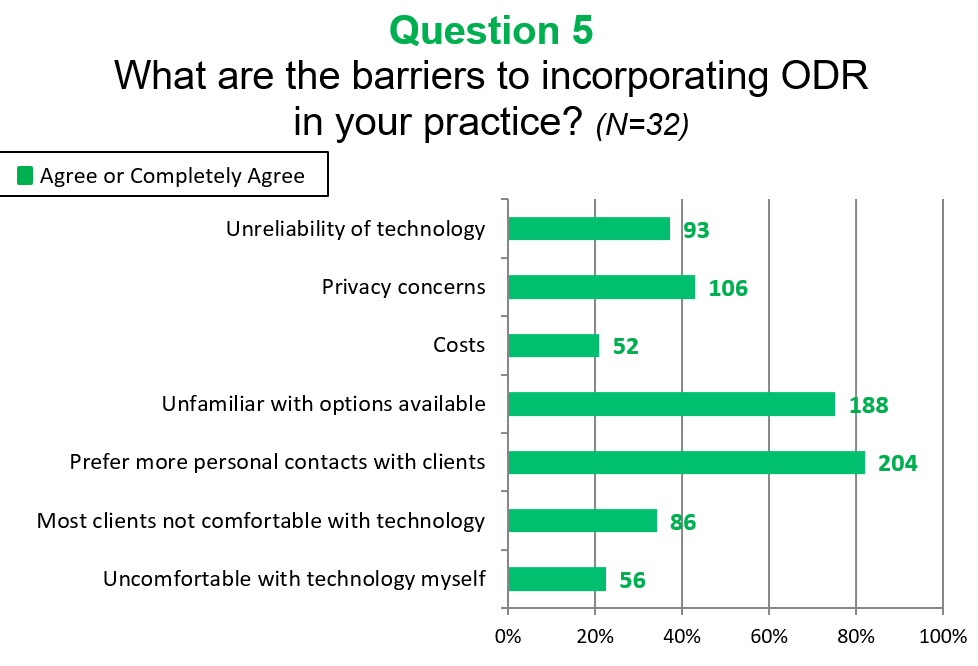

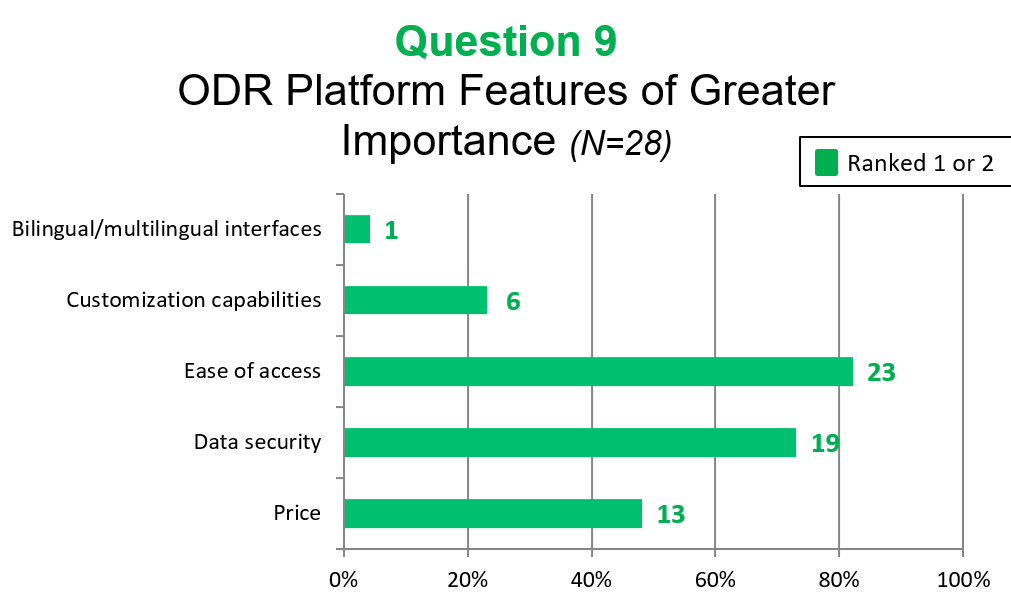

Respondents who answered that they “never” or “rarely” used ODR in their professional practice (n=267) were redirected to different questions than those who answered that they “regularly” or “frequently” used ODR (n=31). This explains why questions 5, 7, 8 and 9 were answered by a smaller group of respondents.

Question 6

What would encourage you to increase the use of ODR in your practice? (N=206)

The Task Force reviewed the open-ended responses and some notable statistics included:

1. Approximately 41% of answers identified education and training as their greatest need prior to using ODR. Many of these responses also asked for resources to be developed which identify the appropriate tools and how they can be implemented for use in ODR.

2. Approximately 15% of answers identified increased public awareness, client willingness, and proof that ODR could be implemented successfully into practice.

3. A similar number of responses (~15%) answered that they required more assurances of the feasibility, reliability, ease of use, and security of ODR technological tools.

4. Lowered costs was also mentioned in several responses (~5%), as was institutional barriers to implementation for members who operate an ADR practice within an institutional setting.

Question 8

List by brand name and rank in order of preference the top three ODR tools you have used (1 being the most preferred, 3 the least). (N=23)

The Task Force has reviewed the responses and makes the following observations:

1. Thirteen (56.5%) of respondents identified a videoconferencing solution as their preferred ODR tool. Of these 13 responses, eight responded that Zoom was their preferred tool. Other notable conferencing tools identified were Skype and GoToMeeting.

2. Only one respondent identified a devoted ODR platform (Mediate2Go) as a preferred tool.

3. The other top preferred tools were e-mail and telephone.

4. Four of the first-choice responses identified internal ODR systems developed for government and other agencies.

These survey results were taken into consideration when providing the recommendations at the conclusion of this report. In particular, the survey highlighted the demand for:

a) More training and education about ODR provided through ADRIC;

b) Development of a code of conduct with respect to ODR; and

c) Ensuring that ODR is secure and respects users’ privacy concerns.

d. Impact of ODR on ADRIC: The Task Force will conduct a preliminary SWOT (strengths, weaknesses, opportunities, threats) assessment of ADRIC vis-a-vis ODR.

i. Strengths of ADRIC relating to ODR

i. Dispute resolution leadership in Canada

ii. Depth of membership – arbitrators and mediators

iii. Available pool of dispute resolution professionals

ii. Weakness of ADRIC relating to ODR

i. Lack of technological expertise to assess systems / platforms

ii. Lack of experience with use of ODR

iii. Members less adept with the use of technology may feel threatened

iii. Opportunities for ADRIC relating to ODR

i. Partner with ODR provider to make approved platform available to members

ii. Train and offer certification for members

iii. Lever off approved platform and trained professionals to attract users (revenue)

iv. Threats to ADRIC arising from ODR

i. Will be left behind as ODR increasing takes hold

ii. Lose ADR market share to more aggressive ODR providers

iii. Concern that the rise of dispute resolution tools incorporating artificial

intelligence may give ADR a bad name.

iv. Public perception that ADRIC failing to adapt to and embrace technological

changes

e. Provide a report and recommendation to the ADRIC Board by March 31, 2019 to identify which, if any, ODR platform would be appropriate for ADRIC to:

• brand as ADRIC’s if possible

• offer to members free or at a discount to help build their practices

• have in place as a tool to help build credibility for our members and ADRIC/Affiliates with potential clients

• use as a marketing tool to encourage rosters for members from government, large corporations

• offer a tool that encourages accessibility

i. The type of ODR platform which appears to be of most interest would be one specifically designed for use by ADR professionals integrating the following functionality:

i. messaging / email,

ii. video and voice conferencing, with ability to conduct private caucusing

iii. document sharing

iv. blind bidding

all in a robust, easy to learn and use, (ultra) secure application

ii. The Task Force has become aware of a number of available platforms that offer all or some of the foregoing functionality but no steps have been taken to further investigate any of those platforms.

f. Implementation: Support Implementation of Task Force’s proposals after ADRIC Board Approval.

i. Deferred pending completion of above.

3. Recommendations and Next Steps for the Task Force.

a. Take steps to increase number of members on ODR Task Force in light of attrition.

b. Focus research on ODR Platforms that might meet the needs of ADRIC members with a view to identifying 2 – 3 providers who might be invited to submit a proposal to ADRIC

c. Prepare draft ADRIC ODR Mission / Vision statement for ADRIC Board to consider and adopt with or without revision.

d. Code of Conduct: Review current Code of Conduct to determine if ODR-related revisions required or if stand-alone ODR Code of Conduct required.

e. Give particular consideration to creation of minimum privacy / security standards to be utilized with ODR.

f. Submit Final Report to Board by a date to be established by the Board in consultation with the Task Force.

4. Conclusion

Improving technologies, including 5G networks, and decreasing cost to access those technologies make it likely that an increasing number of disputes will be resolved using ODR. This will include disputes that have traditionally been dealt with in the Courts and private ADR forums (mediation / arbitration), as well as new disputes that would not formerly have been

pursued due to the transaction costs of doing so.

We are already experiencing the impact of ODR in the public sector (BC’s Civil Resolution Tribunal and Ontario’s Condominium Authority Tribunal) and this trend towards public sector

online dispute resolution can be expected to grow as it offers government cost savings and users convenience.

For the ADR private sector the uptake will likely be slower. While email, online file sharing and video conferencing are widely used by ADR professionals the use of integrated ODR platforms

is unlikely to increase significantly until more is known about such platforms and the concerns raised in the Survey have been satisfactorily addressed.

Online blind bidding systems, such as CyberSettle or SmartSettle may increase in use but appear to offer limited opportunities to traditional ADR providers as the settlement negotiations

are run by computer.

It is important for ADRIC to continue to monitor developments in this area and to seek opportunities to demonstrate leadership as the use of ODR continues to grow.

Submitted by ADRIC ODR Task Force: Rick Weiler (Outgoing Acting Chair), Andrew Eckart (Incoming Acting Chair), Harold Arkin (Acting Secretary), Colm Brannigan, Marie-Claude

Asselin, Emilie Péch, Clara Puskas, Elizabeth Murray, Heather Carnegie, Lea Karen Kivi, Frank Fowlie and Sandra Koop Harder.